- NVIDIA Corporation

Nvidia Corporation (NVDA) is a publicly traded company on the NASDAQ stock exchange.

Nvidia is a well-known technology company that specializes in graphics processing units (GPUs) and other computer-related technologies. The company’s stock has experienced significant growth over the past decade due to its strong performance in the gaming industry. This company have more scope in future because it follows hardware system business.

Nvidia made the best graphics in the world.

Nvidia stocks Are performing best in the past 10 years.

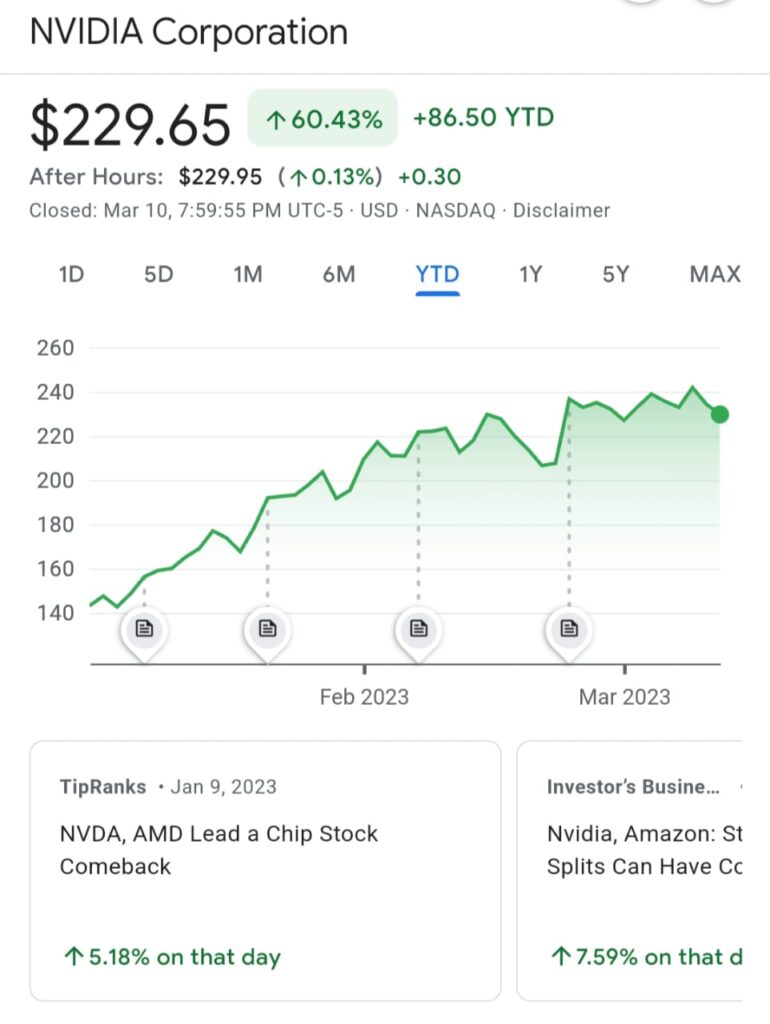

2. Apple Inc

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, United States. Apple’s analyst rating consensus is a Strong Buy. This is based on the ratings of 30 Wall Streets Analysts. Apple’s stock reached an all-time, split-adjusted high of $182.94 in January of 2022. … What Was Apple’s Lowest Stock Price? Apple shares traded as low as $0.04 per share in July of 1982.

.

Apple gonna be the best-performing stock in history better buy and trust this company.

Apple is the world’s most valuable publicly traded company, with a market capitalization of over $2.4 trillion.

As of September 2021, Apple’s stock has had a five-year return of around 300%, and a ten-year return of over 1,000%. The company’s stock price has been supported by strong revenue growth, profitability, and a loyal customer base.

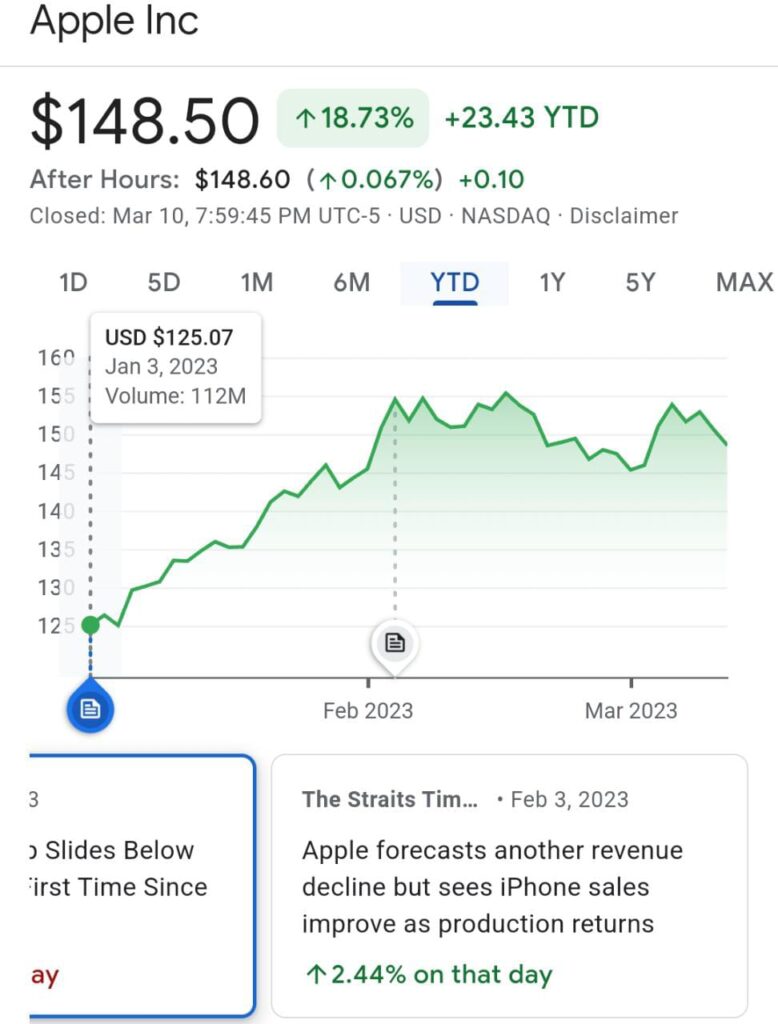

3. ASUSTEK Computer Inc

ASUSTek Computer Inc. is a Taiwanese multinational computer and phone hardware and electronics company headquartered in Beitou District, Taipei, Taiwan. ASUS is a multinational computer hardware and electronics company based in Taiwan that produces a wide range of products, including laptops, desktops, smartphones, motherboards, graphics cards, and other computer peripherals. However, some of its products have been praised for their quality and performance. If ASUS ever decides to go public, its stock performance will be available for investors to analyze.

Asus stocks have performed very well for the past 5 years this company has some future.

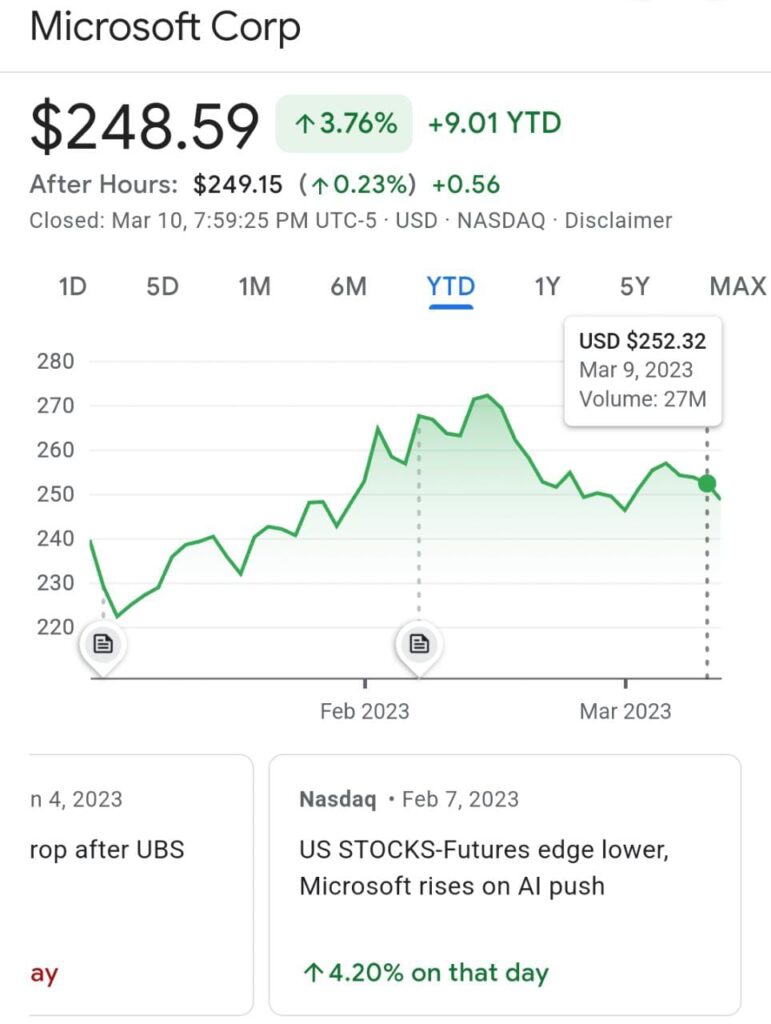

4. Microsoft Corp

Microsoft Corporation is an American multinational technology corporation headquartered in Redmond, Washington, United States. Microsoft’s best-known software products are the Windows line of operating systems, the Microsoft Office suite, and the Internet Explorer and Edge web browsers.

Microsoft recently invest in open Ai Chat Gpt 1 billion$ dollars.

Microsoft is one of the companies that has invested in OpenAI, the research organization that developed and maintains the GPT (Generative Pre-trained Transformer) language model, of which ChatGPT is a variant. In 2019, Microsoft invested $1 billion in OpenAI as part of a partnership to jointly develop advanced AI technologies.

Chat Gpt getting popular among teens so fast everyone saying chat Gpt is the next google of our future.

Microsoft’s analyst rating consensus is a Strong Buy. This is based on the ratings of 30 Wall Streets Analysts.

5. TSLA

Tesla is accelerating the world’s transition to sustainable energy with electric cars, solar, and integrated renewable energy solutions for homes.

Tesla delivered just over 1.3 million electric vehicles in 2022. Before the cuts, Wall Street was projecting about 1.8 million vehicles sold in 2023. Now that Tesla has cut the prices of its vehicles, Barrons says the all-electric carmaker will continue to sell more and more vehicles.

The 38 analysts offering 12-month price forecasts for Tesla Inc have a median target of 205.00, with a high estimate of 320.00 and a low estimate of 24.33. The median estimate represents a +5.77% increase from the last price of 193.82.

The estimated average Tesla stock price for 2040 may be approximately $14,664. The formula may work well for those who already buy a stock during 2022-23